Are FHA Loan Credit Score Rules Different in Virginia?

FHA Basics and Their Nationwide Standards

FHA loans are popular for a reason. They offer flexibility for first-time homebuyers, those with less-than-perfect credit, and buyers with limited cash for a down payment. Since theyre backed by the Federal Housing Administration, these loans follow national guidelinesbut how theyre applied can differ locally.

At the federal level, the credit score rules are clear:

-

580 or higher: Qualifies for a 3.5% down payment

-

500 to 579: Still eligible, but requires a 10% down payment

-

Below 500: Generally not eligible for FHA financing

So if youre wondering about FHA loan credit score requirements Virginia buyers face specifically, the answer lies in how local lenders apply these rules in real-world situations.

Local Lenders Interpret FHA Credit Standards Differently

While the FHA sets the floor, Virginia lenders often raise the bar. This isnt because theyre trying to make life harder for borrowersits about risk management. Many lenders set their own credit overlays, which are internal policies requiring higher scores than the national minimum.

Heres how that looks in practice:

-

Most Virginia lenders prefer a minimum credit score of 620 or 640

-

Lower scores may lead to limited lender options, stricter underwriting, or higher interest rates

-

Some lenders in Virginia wont work with borrowers under 580 at alleven though the FHA technically allows it

That means your eligibility isnt just based on federal guidanceits also shaped by the comfort level of individual lenders who serve Virginia borrowers.

Factors That Make Virginias Approach Unique

Virginias housing market is dynamic. From pricey urban areas like Arlington to rural communities in Southwest Virginia, housing prices, borrower needs, and local loan limits vary widely. Lenders adapt their credit policies based on:

-

Loan limits by county: High-cost areas like Fairfax allow larger loan amounts, which may prompt stricter scrutiny

-

Regional economic stability: Markets with rising home values may allow lenders to be more flexible

-

Borrower demographics: First-time buyers, military families, and retirees influence regional lending policies

-

Fraud risk in localized areas: Some regions implement stricter credit standards to avoid risk

In short, FHA credit score rules arent technically different in Virginiabut how theyre applied absolutely can be.

Additional Considerations for FHA Loans in Virginia

Even with the right score, your loan journey includes other key factors that lenders weigh:

-

Debt-to-income ratio (DTI): FHA allows up to 43%, but some Virginia lenders may require lower ratios for scores under 640

-

Employment history: Expect at least two years of consistent income

-

Down payment source: Gift funds are allowed, but documentation matters

-

Property appraisal: Homes must meet minimum standards for health and safety

-

Loan purpose: FHA loans cant be used for vacation homes or investment propertiesit must be your primary residence

These requirements arent exclusive to Virginia, but how strictly theyre enforced often depends on your credit profile and lender policies.

How to Find Flexible FHA Lenders in Virginia

Not all lenders are created equaland not all apply FHA rules the same way. To increase your chances of success:

-

Work with mortgage brokers who partner with multiple lenders

-

Explore local credit unions and regional banks, which may offer more personalized underwriting

-

Look for lenders who specialize in FHA or low-credit lendingtheyre more likely to help you navigate a score below 640

-

Contact Virginia Housing (formerly VHDA), which offers loan programs paired with FHA guidelines and credit assistance

These lenders often understand the nuances of Virginias market and offer tools to help first-time or credit-challenged buyers get into homes.

Tips to Strengthen Your Credit Score Before Applying

Improving your scoreeven by 20 pointscan change your loan terms dramatically. Consider these strategies:

-

Pay down high credit card balances

-

Avoid applying for new credit in the months before your loan application

-

Dispute errors on your credit report

-

Make consistent, on-time payments across all accounts

-

Keep old credit accounts open, even if theyre unused

In Virginias busy housing markets, a slightly higher score can make you a more competitive borrower and reduce potential interest costs.

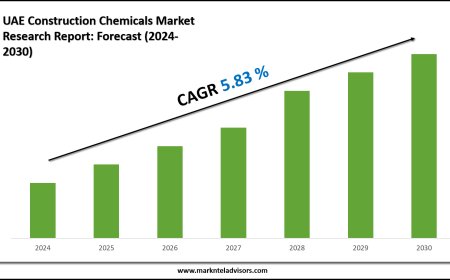

FHA Loan Limits Vary Across Virginia Counties

Heres another detail that affects your FHA journey: loan limits. In 2025, Virginias FHA limits range dramatically:

-

Fairfax, Arlington, and Loudoun Counties: Up to $1,149,825 for single-family homes

-

Botetourt, Wise, and Buchanan Counties: Around $472,030

If youre buying in a high-cost region with a lower score, lenders may scrutinize your file more carefully. A strong credit profile helps you qualify for larger loan amounts, especially in high-demand areas.

Alternatives If FHA Isnt a Fit for Your Credit Score

If your score doesnt meet FHA guidelinesor you dont qualify with Virginia lendersthere are other options:

-

VA loans: No minimum credit score, no down paymentavailable to military members and veterans

-

USDA loans: For eligible rural properties and borrowers with limited income

-

Virginia Housing conventional loans: May work with lower scores through partner programs

-

Rent-to-own or seller financing: Less common, but may be possible with flexible sellers

Dont assume its FHA or bustthere are other pathways to homeownership.

Final Thoughts: Credit Rules Are Standard, But Application Varies

To answer the question: FHA loan credit score requirements Virginia buyers face are not technically different from national guidelines. But how lenders in the state interpret and enforce those guidelines absolutely varies.

Success depends on:

-

Your score

-

The lender you choose

-

Where in Virginia youre buying

-

Whether you explore regional programs that support credit improvement

So if your score is hovering below 620 or 640, dont give up. Do the work, connect with the right professionals, and stay curious. With preparation and persistence, the home you want may be closer than you think.