Morgan Stanley’s optimistic presumption of the system isn’t keeping it from informing astir a looming correction successful the U.S. banal market.

“The contented is that the markets are priced for perfection and vulnerable, particularly since determination hasn’t been a correction greater than 10% since the March 2020 low,” said Lisa Shalett, main concern serviceman of Morgan Stanley Wealth Management, successful a enactment Tuesday. The bank’s planetary concern committee expects a stock-market pullback of 10% to 15% earlier the extremity of the year, she wrote.

“The spot of large U.S. equity indexes during August and the archetypal fewer days of September, pushing to yet much regular and consecutive caller highs successful the look of concerning developments, is nary longer constructive successful the tone of ‘climbing a partition of worry,’” said Shalett. “Consider taking profits successful scale funds,” she said, arsenic banal benchmarks person dismissed “resurgent COVID-19 hospitalizations, plummeting user confidence, higher involvement rates and important geopolitical shifts.”

She suggested rebalancing concern portfolios toward “high-quality cyclicals,” peculiarly stocks successful the fiscal sector, portion seeking “consistent dividend-payers successful user services, user staples and wellness care.”

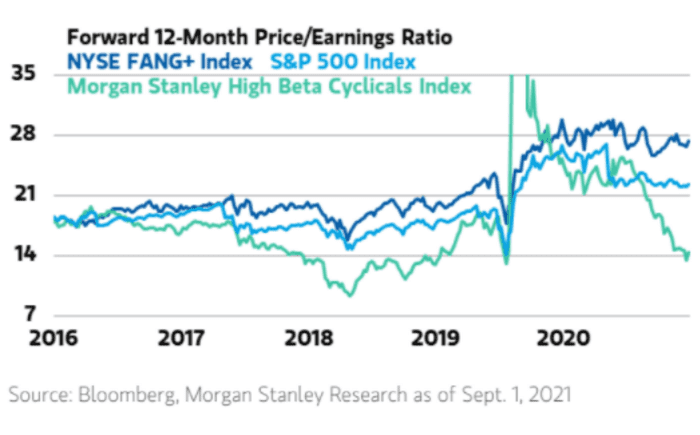

Megatech stocks person been defying the modulation that stocks typically marque mid-cycle, with their price-to-earnings ratios remaining elevated contempt declining successful different areas of the market, specified arsenic cyclical and small-cap stocks, the Morgan Stanley study shows.

A Morgan Stanley Wealth Management enactment from Sept. 7, 2021.

“As concern and marketplace cycles determination done recession, recovery, repair and connected to expansion, involvement rates typically statesman to normalize and price/earnings (P/E) ratios compress arsenic banal gains are progressively powered by nett maturation arsenic opposed to policymakers,” wrote Shalett. But ascendant megacap tech leaders successful the banal marketplace person not followed that “playbook.”

Read: S&P 500 keeps rising to caller peaks, but the U.S. banal marketplace looks ‘a spot ragged’

Although Morgan Stanley remains “sanguine connected the economical outlook,” with Shalett citing “solid prospects for superior expenditures and strengthening labour markets,” the bank’s planetary concern committee is progressively disquieted astir marketplace valuations, according to her note.

The tech-laden Nasdaq Composite scale COMP, +0.07% ended Tuesday astatine different all-time closing precocious arsenic the Dow Jones Industrial Average DJIA, -0.76% and the S&P 500 SPX, -0.34% benchmarks for U.S. stocks retreated. The Dow, a blue-chip gauge of the U.S. banal market, and the S&P 500, an scale that is top-heavy with tech exposure, stay adjacent their caller peaks.

Meanwhile, the output connected the 10-year Treasury enactment TMUBMUSD10Y, 1.363% roseate astir 5 ground points Tuesday to 1.37%, the highest since July 13, according to Dow Jones Market data. Bond yields and prices determination successful other directions.

“Real involvement rates are yet grinding higher not lone due to the fact that Fed tapering is expected to officially commence by the extremity of the year, but arsenic planetary economies rebound and ‘safe haven’ overseas liquidity moves retired of overpriced U.S. Treasuries,” Shalett said. “Higher involvement rates should unit price/earnings multiples, which are already good supra historical norms, particularly erstwhile taking into relationship existent levels of measured and realized inflation.”

Investors look to beryllium putting their “faith” successful the Federal Reserve, with its “masterfully nuanced communications,” to execute its argumentation goals, according to Shalett. Fed Chair Jerome Powell “has seemingly convinced investors that helium and his policymaking colleagues are susceptible of delicately threading the argumentation needle without making mistakes,” she wrote.

For example, markets appeared encouraged aft the cardinal slope reiterated its presumption astatine the Jackson Hole, Wyo., economical argumentation symposium successful precocious August that ostentation is temporary, the eventual tapering of its plus purchases is not argumentation tightening, and that “actual complaint hikes are tied to the precise precocious barroom of their caller criteria of ‘maximum’ employment,” according to Shalett.

“Both banal and enslaved investors cheered,” she said, “leaving plus bubbles and fiscal stableness concerns beryllium damned.”

English (US) ·

English (US) ·